In remote work environments, manual expense processes do not just slow things down, they create risks. Lost receipts, delayed reimbursements, policy non-compliance, and poor visibility into spending trends all add friction. What modern finance departments need is real-time insight, intelligent automation, and full accountability across distributed teams.

This brings us to a growing market of mobile expense tracking apps, each vying to serve the evolving needs of businesses with flexible workforces. While several platforms offer varying degrees of functionality, some distinguish themselves through thoughtful design, compliance strength, and mobile performance.

Here is a closer look at five apps making an impact, with particular attention on ExpenseVisor, a leading platform redefining how remote teams manage spending.

ExpenseVisor

Best for: Businesses that prioritize control, automation, and real-time visibility in mobile environments.

ExpenseVisor is designed with modern finance teams in mind. Built to scale across organizations of all sizes, its mobile-first functionality empowers users to submit, review, and approve expenses with speed and clarity. What sets it apart is how seamlessly it blends advanced controls with user-centric design.

Remote employees can capture receipts, categorize transactions, and track spending trends directly from their mobile device. At the same time, finance managers benefit from automated policy checks, AI-driven approval workflows, and instant alerts for non-compliant submissions. The app’s intelligent audit trail ensures that nothing slips through unnoticed.

ExpenseVisor also stands out in its support for customizable rulesets. Whether your company operates in one market or ten, the platform adapts to regional tax laws, reimbursement limits, and currency conversions. Its analytics dashboard delivers high-level insight across teams and departments, enabling better forecasting and more strategic budget allocation.

In short, ExpenseVisor offers more than mobility. It delivers actionable insight, operational consistency, and scalable control, all from a single, intuitive platform.

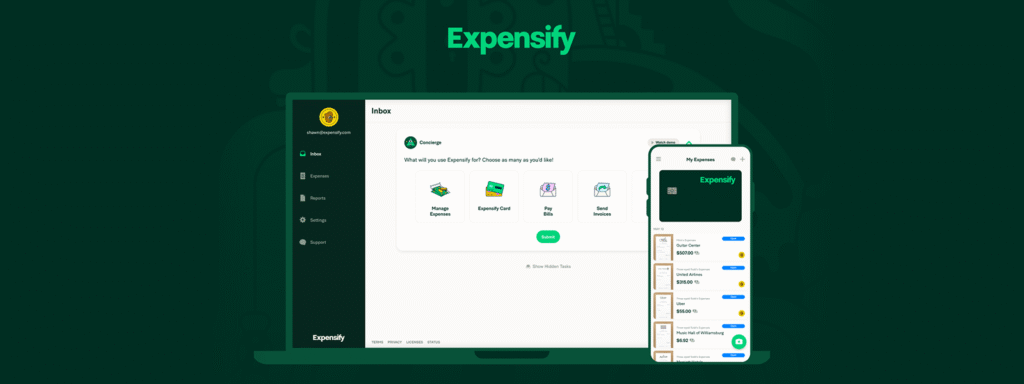

Expensify

Best for: Startups and small teams looking for quick deployment and automated receipt scanning

Expensify has long been a staple in the expense management space. Its mobile app is praised for simplicity and ease of use, especially for employees who need to file expenses on the go. The SmartScan feature allows users to snap a receipt and have the app auto-populate expense data with reasonable accuracy.

For businesses with lightweight approval structures and fewer reporting requirements, Expensify performs well. However, it lacks the deeper configuration controls that more complex teams often require. Companies looking to standardize compliance or segment expense policies by department may find limitations.

Expensify works best as a quick-start tool for smaller teams but may require switching platforms as organizational complexity increases.

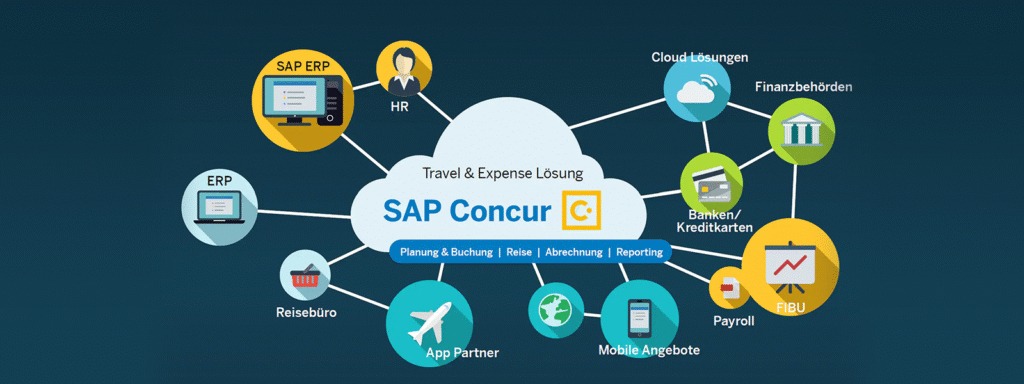

SAP Concur

Best for: Large enterprises with strict policy frameworks and regulatory requirements

SAP Concur is known for its enterprise-grade infrastructure. It is built to handle layered approval processes, extensive policy enforcement, and integration with global enterprise resource planning (ERP) systems. The mobile app brings many of these features into a mobile interface, though the experience can feel dense compared to more modern designs.

For distributed teams working in heavily regulated industries, such as finance, pharmaceuticals, or energy, Concur’s emphasis on governance and traceability can be valuable. However, ease of use is not its primary strength. The mobile app serves a function but may not be the most efficient choice for companies seeking simplicity and speed.

ExpenseVisor competes well here by offering equivalent control without the complexity, giving finance leaders flexibility without compromising oversight.

Zoho Expense

Best for: Mid-sized teams already using the Zoho ecosystem

Zoho Expense delivers a solid mobile experience at a competitive price point. Its strongest appeal lies in its integration with the broader Zoho suite, allowing companies already using Zoho CRM or Zoho Books to centralize operations more easily. The mobile app includes GPS-based mileage tracking, receipt uploads, and approval routing.

For growing companies with moderate reporting needs, Zoho Expense offers a good balance of usability and functionality. It supports multi-currency expenses and can be customized to reflect various policy tiers.

That said, for teams that require advanced auditing tools or predictive insights, Zoho Expense may fall short of platforms like ExpenseVisor, which leverage machine learning to elevate reporting accuracy and compliance forecasting.

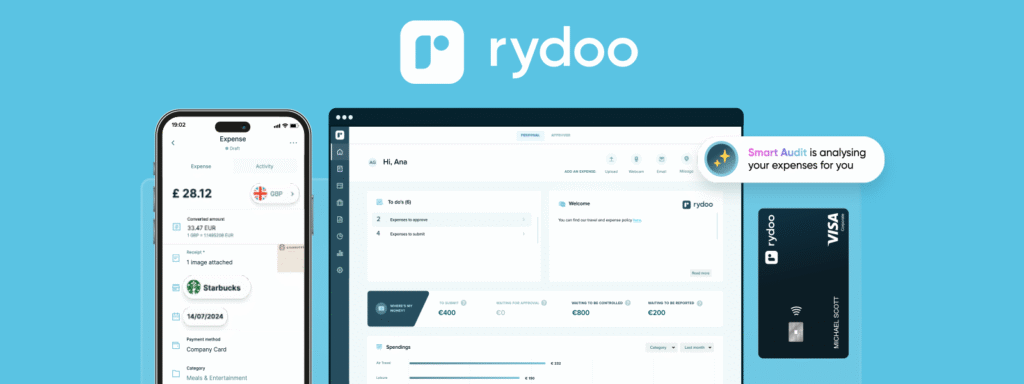

Rydoo

Best for: Companies with frequent business travel and international teams

Rydoo has positioned itself as a travel-integrated expense solution. Its mobile app offers real-time expense tracking and supports region-specific compliance features such as local tax thresholds and per diem management.

The platform is agile and accessible, designed to work well across teams operating in different countries. Its strength lies in its mobility and responsiveness, which serve traveling teams particularly well.

While Rydoo does offer policy enforcement and audit trails, these features are not as deeply customizable as those found in more enterprise-focused platforms. For companies that rely on mobile access but need layered approval logic and detailed reporting, ExpenseVisor presents a more comprehensive option.

Selecting the Right Platform for Distributed Teams

In choosing a mobile expense tracking app, organizations must weigh more than just cost or convenience. The ideal platform should match the complexity of the company’s structure, align with its compliance requirements, and adapt to the pace of remote work. It should also help finance teams move away from reactive reporting and toward proactive financial decision-making.

Among the options available, ExpenseVisor provides a rare blend of control, automation, and usability. It meets employees where they are, on their phones, in the field, across time zones, and supports finance managers with the insight and confidence needed to manage expenses in real time.

For organizations serious about visibility, governance, and mobile efficiency, ExpenseVisor delivers more than a tool. It delivers a framework for smarter, more transparent financial operations.