Sending money across borders is routine work for many businesses. You enter your funds, approve the transfer, and assume the bank will handle everything efficiently. The reality, however, is different. International payments cost far more than you think. As a result, finance teams lose thousands of bucks every year to hidden fees as banks show you a low transfer fee while marking up the exchange rate. This article discusses what those costs are and how they are impacting businesses.

The Common Belief: “Banks Are the Safest Option”

Banks are trusted institutions. They’re familiar, regulated, and widely used. Thus, it’s natural for many businesses to consider banks as the most reliable and safest option for international payments, assuming a higher fee is the price of that safety.

The thing is, security is rarely the issue. In fact, outdated processes and a lack of transparency are what make international bank transfers challenging. Most people don’t overpay because they made a risky choice, but because they don’t see the full cost until it’s too late.

Bank Fees on International Payments: Why Are They So High?

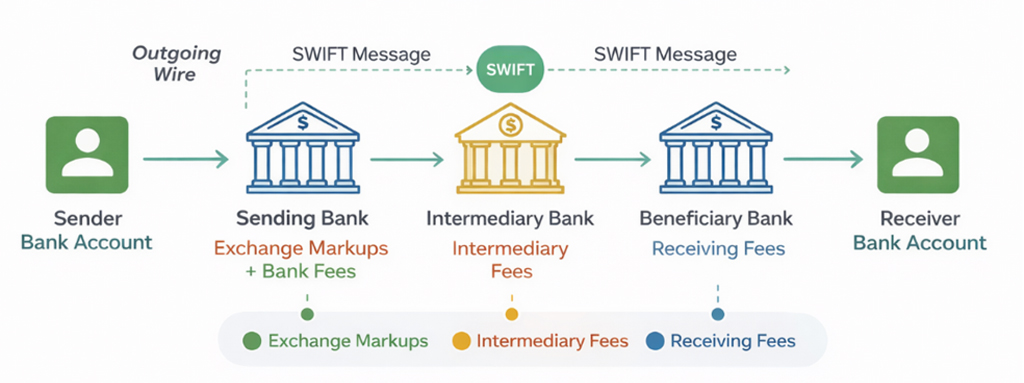

To understand this, you need to see the mechanism. An international bank transfer doesn’t go straight from sender to receiver. It passes through different banks, each adding its own charges on the way. Exchange rate markups, receiving banks, and intermediary fees can all add up to the final amount.

The diagram below shows how a single bank international payment moves through the system and where extra costs quietly appear:

The Standard Costs of International Wire Transfers

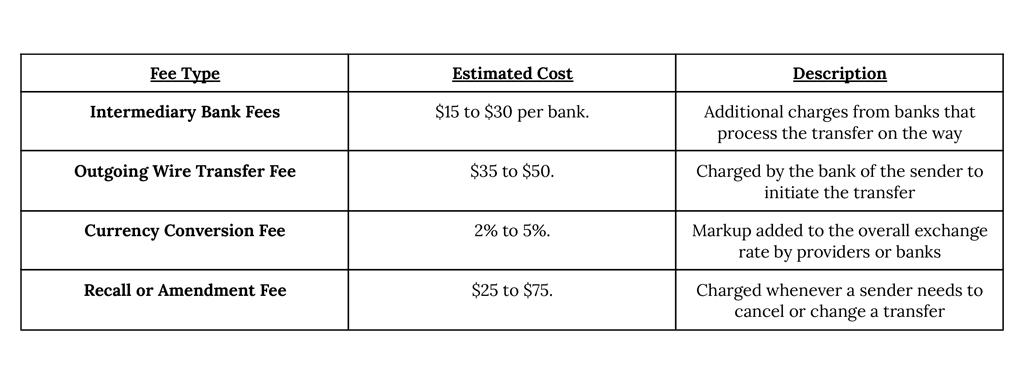

When a bank processes an international wire transfer, some fees are evidently stated. And these are the costs businesses expect already. Depending on the region or bank, wire transfers can involve multiple fees, including:

These bank charges for international payments are disclosed during the transfer process and are listed in fee schedules, too. When they’re high, it’s not a problem as long as there is transparency. Therefore, it only gets tricky when you can’t see yet: the hidden costs.

These bank charges for international payments are disclosed during the transfer process and are listed in fee schedules, too. When they’re high, it’s not a problem as long as there is transparency. Therefore, it only gets tricky when you can’t see yet: the hidden costs.

The Hidden Costs of International Transfers (The Real Problem)

As mentioned above, cross-border payments have hidden payments in the form of:

Exchange Rate Markups

Banks don’t use the mid-market exchange rate you might see on Google. They apply a markup to the rate (or FX spread) on top. When this happens, even a small percentage difference makes a big impact, especially for businesses making high-value international payments.

Suppose you’re converting $120,000 USD to euros:

- Mid-Market Rate: 1.10 → €132,000

- Bank Rate: 1.07 → €128,400

- Hidden Cost: €3,600

When you deal with a large amount of money, this can add up really fast. So before you request an international payment, always look for answers to:

- “What rate is used, and how much margin is added?”

- “Where is the spread disclosed before initiating the payments?”

Intermediary (Correspondent Bank) Fees

International transfers pass through different banks during the process before they reach the recipient. Hence, each intermediary bank may deduct some fee along the way. The sender usually remains unaware of how many intermediaries are involved.

In addition, it becomes difficult to predict how much each bank will deduct. The only way you learn about the final cost is when the payment is completed. All these inefficiencies gradually increase the operating expenses.

Receiving Bank Fees

The recipient’s bank charges fees to process your funds and receive international wires smoothly. These charges vary according to the currency, country, and bank policies. This further reduces the amount that reaches your partner or supplier.

Some banks also apply charges to accept the payments, depending on the method of delivery.

Currency Conversion Timing

Another hidden cost comes from the time the bank takes to convert your currency. Some banks hold your payments for days before exchanging them, eventually exposing you to unfavorable rate fluctuations without warning.

That being said, it creates many problems for businesses:

- Your funds get locked when you wait for conversion

- You lose control over which specific rate is applied

- Market changes can reduce the amount you receive

- Cash flow planning becomes almost unpredictable

How to Reduce or Avoid Hidden International Payment Fees

Here’s how businesses and individuals can minimize hidden international payment fees:

Compare Exchange Rates: Research exchange rates properly, and don’t settle for the first rate you see. Choose the provider that offers a close-to-mid-market rate to reduce unnecessary markups added by banks and intermediaries.

Use Online Transfer Services: When looking for a cost-effective and convenient way to send money, online transfer services are the best to consider. They typically offer faster processing times and clear exchange rate disclosures.

Consolidate Your Payments: Instead of making many small transfers, combine payments whenever possible. Bigger transactions qualify for lower markups, fewer pre-transaction fees, and better negotiated rates.

Hold Multiple Currencies: If you hold your funds in multiple currencies, it helps avoid markups and repeated conversions. This is especially helpful for businesses with predictable payments and improving cash visibility in the long term.

Negotiate for Better Rates: The biggest ten U.S. merchant acquirers processed about $9.5 trillion in card payments. This large-scale payment data shows why volume matters, and this also opens room for negotiation.

Time Your Transfers Wisely: Exchange rates fluctuate throughout the day. Central bank reference rates. ECB time influences market movement. So, understand these patterns to perform transfers for good rates.

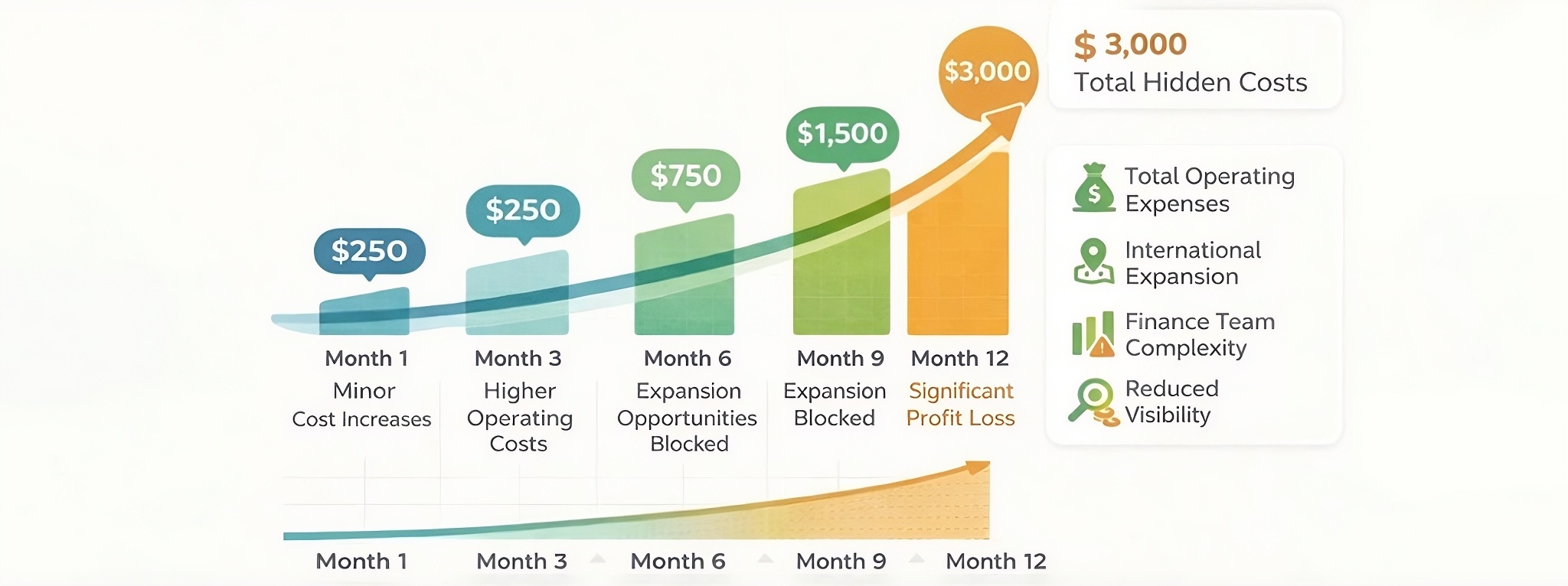

How These Costs Impact Businesses Over Time

Hidden bank transfer fees seem minor on a single transaction, but their long-term impact is substantial. With time, businesses begin to face issues like:

- Higher total operating expenses

- Difficulty expanding international operations

- Complicated reconciliation for finance teams

- Reduced visibility across regions and currencies

How ExpenseVisor Helps Reduce International Payment Costs

As global payments revenues are expected to reach $3.2 trillion by 2027, the demand for finding fair, transparent pricing is higher than ever before.

The good news is that platforms like ExpenseVisor can support better financial control of international money transfers. Meaning you can handle international payment costs from a control and visibility perspective. It helps businesses track cross-border expenses in real time, categorize costs across currencies, centralize expense data linked to international transactions, and more.

Not only this, but it also has features like structured reports, vendor analytics, and receipt capture that make it easier to identify where costs are increasing. That way, you can understand where the money is going and why, reducing the hidden risks.