AI is taking over, and corporations of every scale are incorporating & investing in it in their workflows like never before. It isn’t limited only to emails, but automating every core aspect of their business, including finance.

However, in this age, some still stay reluctant to adapt to the AI-world and manage their workflows traditionally. Which one is better? Should you do it too? Read this article to understand the differences between AI vs. traditional teams, and which one works best in terms of scalability, accuracy, cost, and more.

AI vs Traditional Finance Teams: A Quick Comparison Table

Factor | Traditional Approach | AI-Driven Approach |

Processing Speed | Manual or semi-automated | Near real-time automation |

Accuracy | Human-dependent | Pattern-based consistency |

Scalability | Headcount-based | System-based |

Cost Structure | Fixed salaries + overhead | Predictable software cost |

Error Handling | Reactive | Preventive and corrective |

Forecasting | Historical and manual | Predictive and dynamic |

Key Differences Between AI and Traditional Finance Teams

When it comes to finance management, the differences between AI-driven and traditional methods are quite evident. Here’s how both these approaches differ in various aspects:

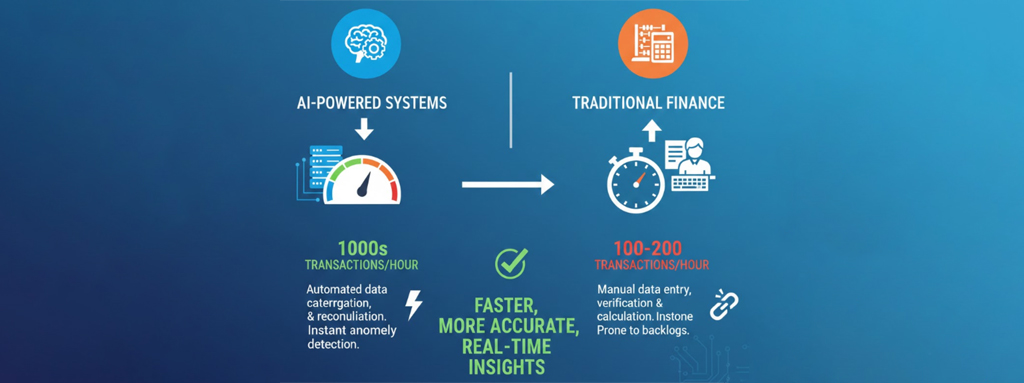

1) Transaction Processing Speed

Traditional workflows usually rely on manual approvals, entries, and reconciliation. Even with basic tools, it is difficult for the team to process invoices or journal entries early, as it requires sufficient time and concentration. In turn, this leads to delays during peak periods, such as the month-end close.

In contrast, AI financial process automation works differently. It manages big transaction volumes simultaneously. That means everything operates automatically, including data extraction, validation, and categorization. With this system, organizations can close books quickly and respond to financial signals without manual updates.

2) Consistency & Pattern Recognition

Workflows in traditional accounting are impacted by inconsistencies when multiple staff members manage similar transactions with different interpretations, causing reporting irregularities. However, on the positive side, traditional finance relies on human judgment to identify unusual/unique situations, whereas AI does not. It only acts according to the data it’s fed.

Meanwhile, AI finance strategy excels at maintaining long-term consistency across thousands of transactions. This is possible because machine learning models are well-trained on data, recognize patterns, and apply automatic standardized treatment. This makes things easier and quicker for organizations dealing with multiple accounting personnel.

3) Scalability & Accuracy

Scaling a traditional finance operation means you’ll need to hire more people from time to time. Each additional workload increase needs onboarding, management, and training. Not only does it consumes times, but it also costs heavily, increasing the chances of errors and incoherence. More so, during rapid growth phases.

AI for accounting teams, by contrast, scales horizontally. That means, no matter if you’re processing millions of records, the accuracy or performance efficiency won’t be compromised. On top of that, AI systems can adapt more easily through model updates than through headcount expansion, even when transaction complexity occurs.

4) Error Rates & Reliability

In traditional financial management, error rates are comparatively high. Overlooking a small detail translates into costly mistakes, misinformed decision-making, and even compliance issues. Not only this, but manual processes are also prone to human limitations (oversight, fatigue, or inconsistent applications of rules).

An AI accounting system usually demonstrates lower error rates, but that surely does’t mean it’s zero. The thing about machine learning algorithms is that they apply unified rules without distraction, fatigue, or subjective interpretation. Businesses that aim to achieve higher accuracy value AI models. But again, at the end of the day, an expert ( a human) needs to verify.

5) Productivity & Time Reallocation

Traditional finance teams struggle with manual bottlenecks that can turn even simple tasks into multi-day projects. This slows down reporting and financial management, and also creates a “talent drain” where top analysts spend more time auditing cells than driving the strategic decisions they were hired to make.

Low-value and repetitive tasks drain focus and time. AI in finance lifts that burden to help finance experts operate at their full potential. People, especially experts, don’t want to spend the day searching for past reports or formatting data, and claim a productivity boost.

Cost Comparison: AI vs Traditional Finance Teams

Traditional cost structures involve benefits, salaries, turnover risk, management overhead, and training. These costs also increase as operations expand, making long-term predictability challenging.

For AI-based finance automation, a different model is used. Costs are mainly software-related, and teams also have reasonable options to consider, even if they lack resources. Moreover, AI reduces reliance on incremental hiring over time.

Cost Area | Traditional Finance Operations | AI-Enabled Finance Systems | Cost Impact |

Core Staffing & Payroll | $140,000 – $200,000 | $45,000 – $70,000 | Major cost reduction |

Accounting & Finance Software | $4,000 – $10,000 | $14,000 – $26,000 | Higher software spend |

Training & Upskilling | $6,000 – $12,000 | $9,000 – $16,000 | Higher software spend |

Rework & Error Resolution | $18,000 – $35,000 | $3,000 – $6,000 | Significant savings |

Compliance & Audit Readiness | $15,000 – $28,000 | $5,000 – $9,000 | Lower compliance costs |

Initial Setup & Integration | $6,000 – $12,000 | $18,000 – $38,000 | One-time investment |

Estimated Total (Annual) | $189,000 – $297,000 | $94,000 – $165,000 | Net savings over time |

Which One Is Best for Your Needs?

Both traditional and AI teams are important for finance management. Traditional teams help with:

- Judgement-heavy decisions

- Stakeholder communication

- Regulatory interpretation

- Thorough analysis of reports

AI, on the other hand, also works best in rule-based, high-volume, and data-intensive procedures. The best approach would be to choose a hybrid model and let AI handle monitoring, forecasting, and finance automation, while people focus on governance, strategy, and decision-making.

How ExpenseVisor Supports AI-Driven Finance Teams

ExpenseVisor is built for finance teams wanting better control without adding any layers of complexity. Fortunately, it focuses on one of the most time-consuming areas of finance, which is employee expenses, and fixes everything quietly in the background.

Instead of trying to “replace” decisions or people, this platform does something more useful: it makes the numbers reliable, up-to-date, and clean.

Here’s how it helps in real terms:

- Automatically captures and categorizes all expenses when they happen

- Decreases manual corrections and back-and-forth approvals significantly

- Keeps spending across departments and teams very transparently

- Delivers real-time visibility with no disruption to existing workflows

ExpenseVisor supports hybrid finance models where teams spend less time fixing errors, and automation improves accuracy.