Track and Manage Expense Receipts Easily

Capture receipts as they come in and keep them stored in one place. This helps you stay in control of business expenses with more confidence and less hassle.

What Counts as a Valid Receipt?

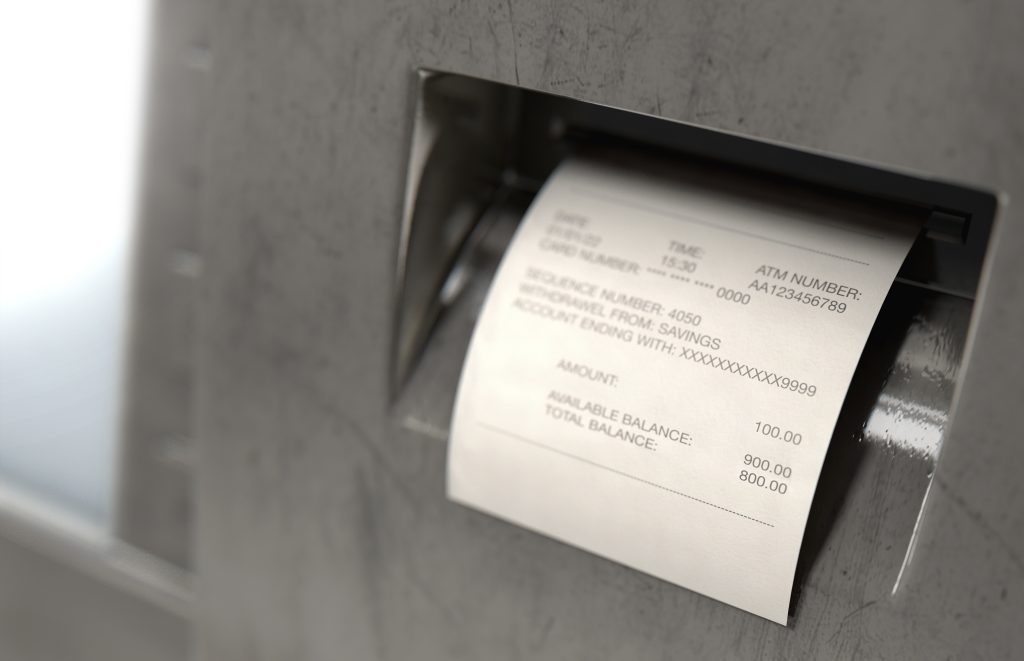

A valid expense receipt is an official document that provides detailed proof of any transaction that is business-related. Key characteristics of a valid expense receipt are:

The expense receipt must have the purchased date on it, verifying its alignment with any expense policies.

The vendor's name and location should be visible to verify that the purchase was made at a legitimate business.

The expense receipt should contain a list of items or services purchased, quantities, and prices.

The total amount, including any applicable taxes, should be visible, which is essential for accurate financial records.

The payment method should be clearly stated, whether paid via cash, card, or other forms. This verifies that the expense has been settled.

- Why Do You Need Expense Receipts?

Receipts are concrete proof that a purchase or expense was made, detailing the item or service, vendor, and payment amount.

Receipts are necessary for tax deductions, as tax authorities often require detailed records to validate claims.

Receipts prove that employees are reimbursed accurately and only for authorized, business-related purchases.

Businesses can analyze costs and identify opportunities to reduce unnecessary expenditures.

You can prevent fraud by tracking receipts, verifying that expenses are legitimate and authorized.

Manual Tracking vs Automated Receipt Tracking

Pros: Faster, more accurate, and it works smoothly with your financial systems.

Cons: Requires an initial setup and may run into occasional technical issues.

Pros: Low cost and easy for small teams just starting.

Cons: Time-consuming, error-prone, and less scalable.